Call it by whatever adjective — a golden walking stick or simply a financial product — reverse mortgage has its own worthiness for every senior citizen above 60 who doesn’t have much retirement corpus. For, not only can it have a significant impact on the quality of life after retirement, it also ensures financial security and a regular income flow for the aging couple for many years.

Let’s get into this financial product and see how it works wonders for people who have inadequate or irregular source of income after retirement. Reverse mortgage is governed by the Reverse Mortgage Scheme, 2008, notified by the Central Government that came into force on April 1, 2008. It defines reverse mortgage as mortgage of a capital asset by an eligible person against a loan obtained by him from an approved lending institution. The approved lending institutions include National Housing Bank, scheduled commercial banks and housing finance companies.

In simpler terms, reverse mortgage means a mortgage in reverse — it’s the loan given to senior citizens against their own property, provided the property is self-acquired, self-occupied and having a clear title deed in favour of the borrower. Unlike the traditional mortgage or home loan where a borrower borrows money from a bank or a housing finance company and then repays it over a certain period of time through EMIs, the opposite is true for a reverse mortgage i.e. the bank or the housing finance company pays tax-free money to the borrower on a periodic basis (monthly or quarterly) depending upon the value of the property and by keeping the borrower’s property as mortgage.

Some banks give loans for a period of 15 years while some for 20 years (which is the maximum period) or till the death of the last surviving spouse, whichever is earlier. The borrower is not required to repay the loan to the bank or the housing finance company as long he and his spouse is alive or as long as both continue to stay in the house. Further, even if the borrower outlives the 15 or 20 year span, he can continue to stay in the house mortgaged to the bank or the housing finance company.

The bank or the housing finance company recovers the loan and the associated interest amount by selling the residential property after the death of both the owner and the spouse and pays the surplus amount, if any, to their heirs. However, the borrower or his/her heirs could also repay the loan and save the property from getting sold.

A variant of reverse mortgage is reverse mortgage loan enabled annuity (RMLeA). Unlike reverse mortgage, which limited the loan disbursement tenure to a maximum period of 20 years, RMLeA pays for life time to the senior citizens. RMLeA is an annuity-linked product where the loan is used to buy an annuity from an insurance company and so the payment is for life time.

Balloon Effect

How Compound Interest On Reverse Mortgage Can Turn Your Home Equity Into A Huge Debt*

How Much Will You Get

Let’s understand it with an example. Suppose the value of your property is Rs 10 lakh and the bank decides to give loan equivalent to 80% of the property value with a loan disbursement period of 15 years. Assuming the interest rate at 10.5% and disbursement frequency monthly, you can expect to get monthly payment of Rs 1,843 from the lender. Similarly, if the value of the property is Rs 30 lakh and the rest of the details remain the same, your monthly tax-free income would come to be Rs 5,530; Rs 6,451 in case the property value is Rs 35 lakh; Rs 7373 if the value is Rs 40 lakh and Rs 8,294 if the value is Rs 45 lakh — nothing to sneeze at, if all of this money is tax-free.

The formula to calculate the reverse mortgage payout is simple.

Installment amount = (PV×LTVR×I) ÷ ((1+I)n-1), where PV stands for property value; LTVR for LTV ratio and n for number of installment payments. The value of 'I' depends on the disbursement frequency. In this case, the property value (PV) = 10,00,000; LTV Ratio (LTVR)=80%; loan disbursement period=15 Years; disbursement frequency = monthly and interest rate(IR) = 10.5 %.

This formula however is not absolute as the amount of loan the borrower gets also depends on the age of the borrower, appraised value of the property and the interest rates of the bank or the housing finance company.

Fine Print: How Reverse Mortgage Differs From Other Mortgage Loans?

| |

Conventional Mortgage (housing loan)

|

Loan against Residential Property (Home Equity loan)

|

Reverse Mortgage Loan

|

|

Purpose of loan

|

To purchase/ upgrade a house

|

To get cash from a residential asset for a variety of personal purposes

|

To get cash from a residential asset for a variety of purposes including home improvement, repairs and personal purposes

|

|

Eligible borrowers

|

Creditworthy borrowers

|

Creditworthy borrowers who have clear title to a house property

|

Senior Citizens who have clear title to a house where they reside permanentl |

| During the loan tenure, the borrower... |

- Makes monthly repayments to the lender

- Loan balance goes down

- Borrower's equity grows

|

- Makes monthly repayments to the lender

- Loan balance goes down

- Borrower's equity grows

|

- Receives payments from the lender

- Loan balance rises

- Equity declines

|

| At end of loan, the borrower… |

Owes nothing to the lender Has substantial equity |

Owes nothing to the lender Has substantial equity

|

loan, the borrower…

Owes nothing to the lender Has substantial equity

Owes nothing to the lender Has substantial equity

Owes substantial amount to lender Has much less, little, or no equity

|

| Modes of repayment |

Monthly (during loan period)

|

Monthly (during loan period)

|

- Sale proceeds of house property used to settle the loan dues, on borrower's demise or giving up home

- Bullet repayment of principal and accumulated interest

- Borrower/heirs have option to prepay or settle loan dues without sale of property

|

The Loan Ranger

A major advantage of reverse mortgage is that as a borrower, senior citizens can select a mixture of disbursement modes, including upfront cash (lump-sum) as well as an annuity payment. However, ignore it at your peril that this payment is not income but a loan that could multiply over the years. This means, if the borrower or his heirs wants to repay the loan, they have to pay not only the loan amount but the interest accrued on the amount over the years as well.

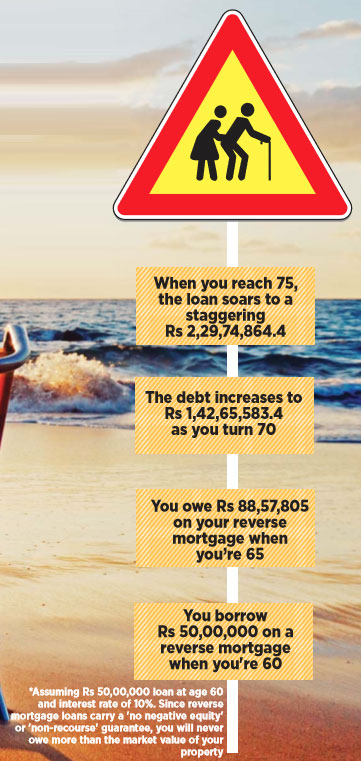

This is s major disadvantage of reverse mortgage in that a small reverse mortgage can turn into a huge debt. A Rs 50 lakh reverse mortgage loan with interest rate of 10% at age 60 will grow to be Rs 1 crore and 42 lak by age 70 and Rs 2 crore 29 lakh by the time you turn 75 (See Balloon Effect).

“Senior citizens may not be aware of the compounding aspect of loan over time and may believe that their repay ment exposure is limited to the principal, which is the assessed value of the property at the time of initiating the reverse mortgage. If the terms are not clearly conveyed, they may not even realise that they are effectively entering into a binding agreement to hand over possession of their house to the lender after their demise,” Kiran Kumar Kavikondala, Director, WealthRays group.

Secondly, experts argue that reverse mortgage concept is complex and it may be difficult to reliably convey all relevant and important information satisfactorily to the potential borrower, thereby increasing senior citizen’s chances of basing their decision on unclear information.

Further, reverse mortgage is not very popular in India and the biggest factor behind it is emotion. As Kavikondala adds, “For years, real estate has been the biggest and the most popular investment avenue for most of Indians. Reverse mortgage has not been popular or not greatly accepted due to emotional attachment as we Indians are very much attached or sentimental about assets we own and it’s difficult to accept especially for senior citizens that lender would sell the property to recover loan eventually.”

Further, the low monthly payout and the limit on loan disbursement period is another disadvantage of reverse mortgage, point out experts. “The monthly taxable amount is far too low considering it's a loan and secondly it’s only for maximum 20 years after which there is no payment. With longevity a genuine risk this is a huge disadvantage,” maintains Jitendra Solanki, SEBI-registered investment advisor and CFP, JS Financial Advisors, New Delhi.

Written By: Sunil Kumar Singh